What to know about the claims process

Why am I getting a bill from my provider before it’s been processed through insurance?

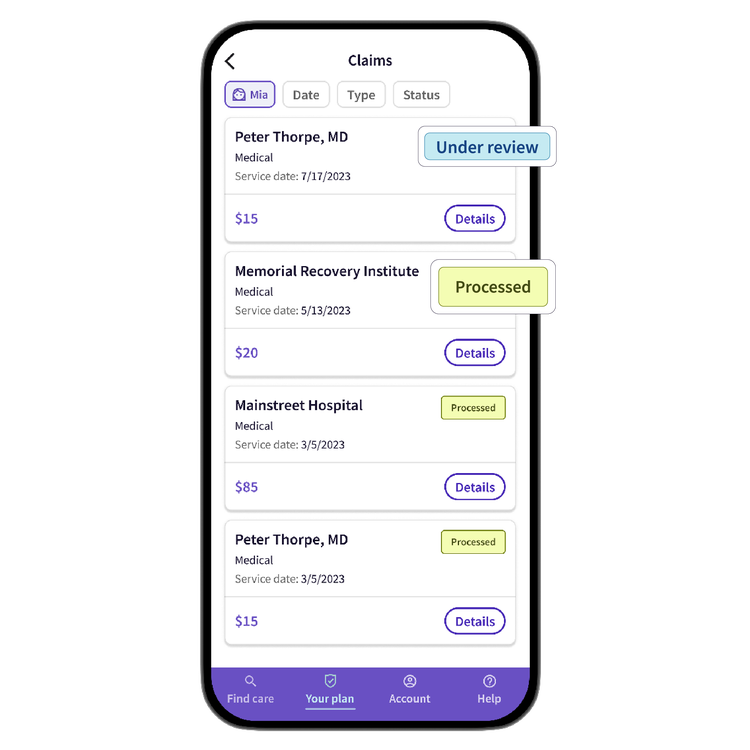

If you get a bill from an in-network provider before Surest has had a chance to process the claim, ask the provider to delay payment. After the claim is processed, check your Explanation of Benefits (EOB) to see the correct amount owed. To confirm that your claim has been processed, simply log in to the Surest app or website and go to the “claims” section.

Why is my bill different than what I expected?

- Your copays can change depending on where you go and which doctor you see. Even the same doctor might have different copays at different clinics. If you’re looking up a specific provider, you’ll see an office copay. But to get an accurate price quote, make sure your search includes the exact service, location, and provider.

- The provider billed something different than expected. For instance, you might be billed for allergy testing instead of allergy shots. If something like that happens, give Member Services a call.

How do I read my Explanation of Benefits?

An Explanation of Benefits (EOB) is a statement from Surest that breaks down the details of a medical service you received. It shows what the provider charged, how much your insurance covers, and what part you may need to pay. The EOB isn’t a bill, it’s just there to help you figure out your costs. If you have questions about your EOB, don’t hesitate to contact Member Services.

Why does it cost more to see an OON provider?

Your Surest plan includes a large network of contracted providers and facilities. These in-network providers have agreed-upon contracted rates, which helps streamline the claims process. Surest can’t regulate out-of-network pricing, which will result in higher costs. (And could also require you to manage the claim submission and prior authorization.) If you’re wondering about network status, call Member Services to confirm.

How does OON billing work?

To make the most of cost savings under the Surest plan, we suggest searching for in-network providers through the Surest app or website. That’s because some plans have no OON coverage, meaning you’ll be on the hook for the full cost of services. If your plan does have OON benefit coverage, Surest will only pay a portion of this cost, or the allowed amount. The allowed amount is the amount considered “reasonable and customary” for the service in your area. For OON services, Surest will apply this allowed amount, even if the provider charges more than that. You will typically be responsible for the OON copay for services rendered.

How do I submit a claim for an out-of-network provider?

There are two ways to submit a claim: paper or digital. We recommend digital for the efficiency and ease of use (plus no fear of losing it in the mail).

For a digital claim, go to “Claims” from the homescreen, then “Start new claim.” You can also go to “Your Plan,” scroll down to “Plan Resources” and then “Medical Online Claim Form.”

For a paper claim, go to “Your Plan,” scroll down to “Plan Resources” and then “Medical Paper Claim Form.” Download and print the OON claim form, then finish and return per the instructions on the form, complete with any relevant documentation.

For your submission to be accepted, the following fields are mandatory and must be present on the receipt (handwritten data is acceptable, as long as it’s legible):

- Member’s Surest ID number

- Patient name

- Diagnosis code

- Name and address of the provider

- Provider tax ID

- Provider NPI (can be manually looked up via NPPES NPI Registry)

In addition, the following fields must be present on each service line on the receipt:

- Date of service

- Place of service

- Procedure code

- Units charged

- Amount charged

If the form is incomplete, you will receive a letter explaining what information is missing. You can then resubmit the claim once you have the required information.

Check your Surest app/website under the “Claims” section to see if your claim has been processed. (Allow up to 30 days.)

You can view the EOB once the claim has been processed.

What is balance billing?

If an out-of-network provider decides to charge you the difference between their total charge and what Surest covers, that’s called balance billing. It’s up to the provider whether they want to balance bill you. Some might ask to see your Explanation of Benefits (EOB) and could choose to write off the extra cost, but they’re not required to since they don’t have a contract with Surest. You might be able to negotiate a different discount or arrangement directly with your out-of-network provider. This would be a private agreement between you and the provider, independent of your Surest benefits. They may still want to see your Surest EOB, though, to refer to the insurance pricing.

For example, if a provider charges $1,000 for a service, but the allowed amount is $600, and your copay is $50, Surest would pay $550 (allowed amount copay). In addition, you could also owe the balance of $400, making your total responsibility $450.

Was this helpful?

© 2016 - 2024 Healthwise, Incorporated. This information does not replace the advice of a doctor.

This content is not medical advice. You should always consult with your health care professional.