Restaurant group avoids increased employer and employee health insurance costs with rich, $0 deductible copay-only, broad network plan.

The Challenge

Thunderdome Restaurant Group faced an extremely high health insurance renewal expense, which would drive up employer and employee costs. They needed to control spending while offering an affordable benefit with a national network to accommodate expanding restaurant locations. With mostly hourly employees, Thunderdome felt a high- deductible plan wasn’t right for the restaurant industry. They wanted a no-deductible copay plan to provide more affordable coverage when employees needed to use their plan.

The Solution

The Surest plan checked all the boxes for Thunderdome Restaurant Group. The $0 deductible, variable copay plan would avoid cost increases for the company and employees. And the Surest plan, with its national network and upfront pricing, would give employees options to choose high- quality care that fits their needs and budget―conveniently listed on the app or website.

The Outcome

Employer impact

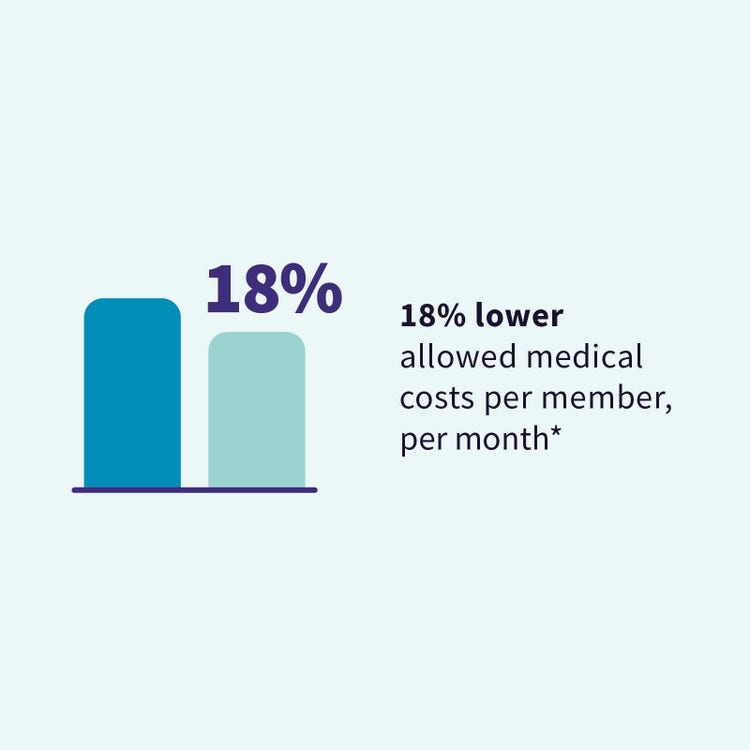

- 18% lower allowed medical costs per member, per month (PMPM)*

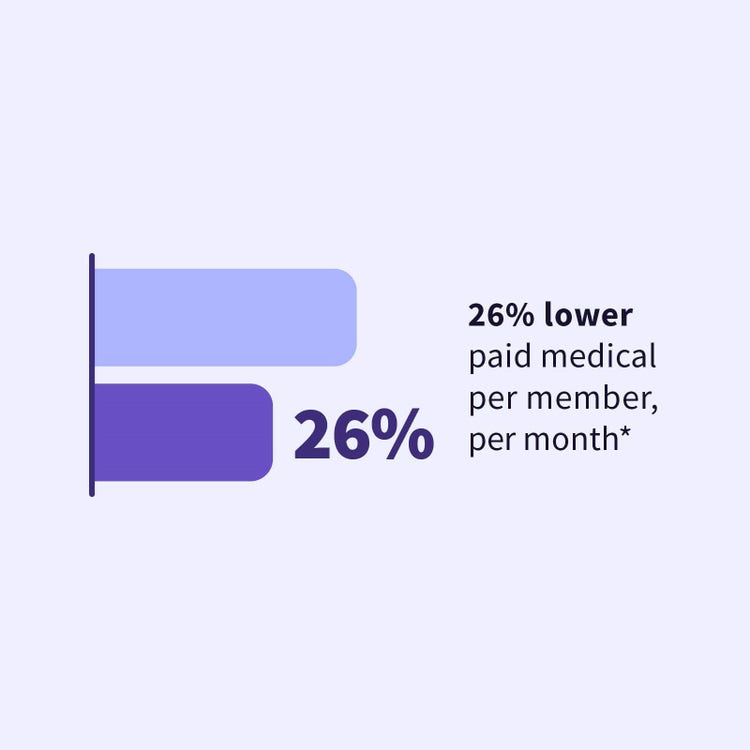

- 26% lower paid medical PMPM*

- 12% lower inpatient admits*

- 23% lower outpatient surgeries*

- 2% higher primary care physician visits*

Employee impact

- Strong employee engagement:

- Members selected the most efficient or second- most efficient providers 46% of the time, in line with the Surest norm (49%) ―enhancing member affordability via lower copays associated with higher-efficiency providers.

- 78% of households registered with Surest

- 77% of members with claims interacted digitally with Surest > 50% higher than the Surest norm.

“Surest makes it easy for members to see all the options for care, with clear, upfront price options at their fingertips. This puts more power into the members’ hands to make informed decisions. Overall, this transparency benefits both the employer and employee.”

-Kier Muchnicki, VP of Team Member Experience

See more client and member success stories.

1 Results incurred January 2023 through September 2023, paid through November 2023. *Surest medical claims compared to a large commercially insured national dataset risk adjusted by gender, age, disease burden, and zip code. Insurance coverage for fully insured plans is provided by All Savers Insurance Company (for FL, GA, OH, UT and VA), by UnitedHealthcare Insurance Company of IL (for IL), by United Healthcare of Kentucky, Ltd. (for KY), or by UnitedHealthcare Insurance Company (for AL, AR, AZ, CO, DC, DE, GA, IA, ID, IN, KS, LA, MI, MN, MO, MS, MT, NC, NE, NH, NV, OK, PA, RI, SC, SD, TN, TX, UT, VA, WV and WY).

These policies have exclusions, limitations, and terms under which the policy may be continued in force or discontinued. For costs and complete details of the coverage, contact either your broker or the company. Administrative services for insurance products underwritten by All Savers Insurance Company and UnitedHealthcare Insurance Company, and for self-funded plans, are provided by Bind Benefits, Inc. d/b/a Surest, its affiliate United HealthCare Services, Inc., or by Bind Benefits, Inc. d/b/a Surest.