When consumers have a choice, they choose high-value, lower cost health care.

The expression information is power is proving true for members on the Surest health plan who, on average, had 54% lower out-of-pocket costs on health care expenses.1 And they aren’t just saving money, they’re also finding high-value care to help them feel better, faster.

Surest is an innovative health insurance plan designed to connect members to cost and care options they can see in advance to make informed decisions about their care. This shift to information sharing — before care — is changing how members use their health insurance to improve their health and reduce their health care expenses.

Removing barriers to care

Common barriers to care are often firmly rooted in access and cost, leading to disparities in health equity. Surest uses the large, national UnitedHealthcare network of doctors, hospitals, and clinics to give its members plenty of care options. The plan design has no deductible and assigns value-based prices (copays) to services, procedures, and supplies that members can see in advance. This innovative approach allows members to shop for care by putting clear choices in the palm of their hand.

Surest assigns copays based on a number of factors, including providers who achieve better patient health outcomes, have lower rates of complications, and use resources more efficiently. When providers, physicians, or treatments are evaluated as high-value, they are assigned a lower copay.

The rationale is that providers with better outcomes — or those who help people get better, faster — should cost less. And members should be aware that the decisions they make about the providers they select and health care services they choose can affect their out-of-pocket expenses.

Members have health care choices, and those choices have the potential to make a difference.

Engaging in care, not avoiding it

A recent Gallup survey found more than one in three Americans regularly avoid medical care because of the cost, including a significant portion who have insurance. The Surest health plan is designed to remove barriers to care like price transparency so members become active participants in their health.

When members understand they can search for cost and care options in advance — without a deductible or co-insurance getting in the way — they’re less likely to skip care and more likely to engage and be proactive about their health.

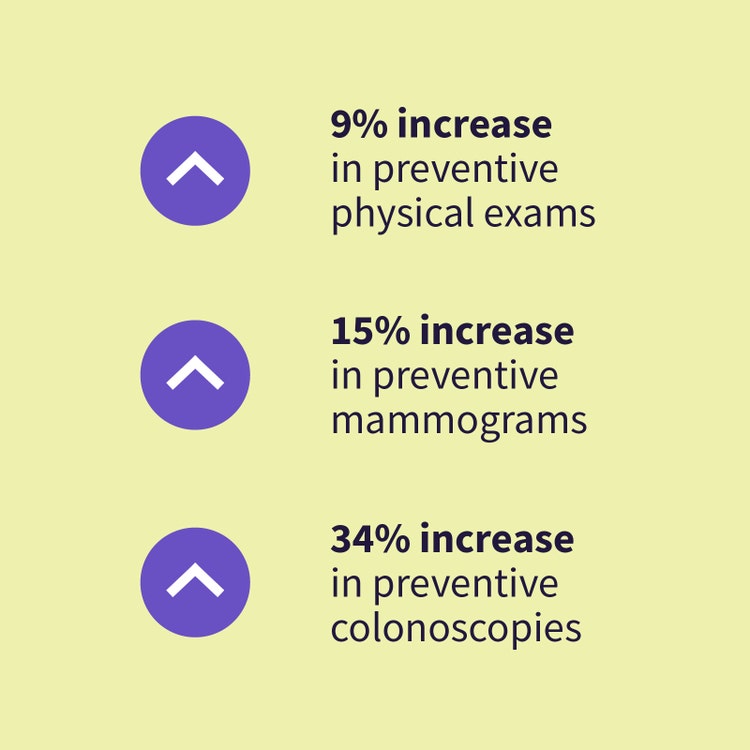

In fact, higher engagement with the Surest health plan has led members to a higher rate of preventive checkups. During these checkups, physicians can help detect potential problems early, when they’re easier (and less costly) to treat. 2

As members become more engaged with their plan, they may also be able to avoid unnecessary or expensive care options.

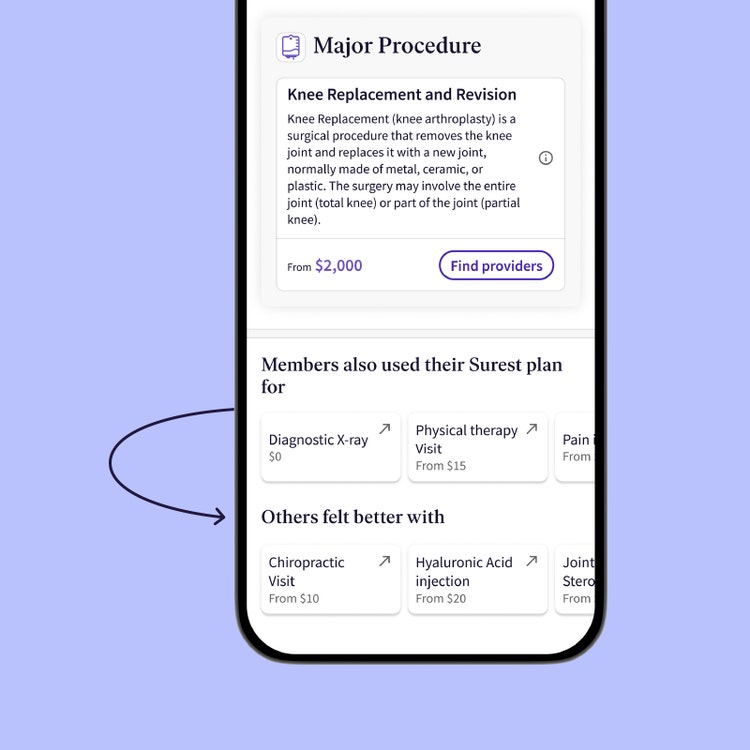

To avoid wasteful health care spending, Surest uses data analytics within the member experience. When a member searches for expensive care options like surgery, they are presented with surgery options as well as less invasive, less costly, and evidence-based options to consider. “Others felt better with” suggestions are presented to members alongside their original search so they can compare options and see what’s included in a visit. Members can then use the information to decide what type of care to get, where to go, how much to spend, or even discuss the options with their care provider before they decide.

In fact, Surest members choose more efficient providers and cost-effective sites of care, as well as less invasive options like physical therapy visits.

Often the biggest barrier to health care is not knowing — where to go, how much it will cost, or what options are available. The Surest health plan aims to eliminate these barriers with an information-first, consumer-driven plan that’s helping members choose quality care that fits their health need and budget.

- Comparison of 2022 medical out-of-pocket spend for members who migrated to a Surest plan in 2022 compared to members from the same employers in a non-Surest plan. 141_V04.

- Comparison of members identified as having 12 months enrollment in a UHC plan in 2021, and 12 months enrollment in a Surest plan in 2022. 167_V01.

Did you know?

Hundreds of employers with a combined workforce of more than 4.4 million employees have opted to offer Surest as a benefit option for 2024, including 1 in 6 national account customers for UnitedHealthcare — making Surest the fastest growing plan among commercial offerings for UnitedHealthcare.